Are you in the GPS tracking business and want to grow it? Expanding into new industries would be a smart move. Vehicle leasing is a great market for your GPS expertise whether you're an experienced service provider or just starting.

In this blog post, we’ll talk about how your telematics and IoT know-how can make a difference in car leasing and expand your presence in the domain.

Unlocking the potential of vehicle fleet leasing

In the car world, leasing is a popular choice. It's a budget-friendly way for people and businesses to use vehicles without a long-term commitment. Plus, lease payments are usually lower than loan payments, making leased cars more affordable.

No wonder that a growing number of people are choosing car leasing. In 2023, the global car rental and leasing market was worth $728.13 billion, and it's still on the rise. Auto industry trends project substantial growth and a 7.6% yearly increase from 2023 to 2030. That means that the car leasing market might reach US$1,139.21 billion by 2030. These numbers show how promising this industry is.

That’s why partnerships with car leasing companies bring exciting opportunities for GPS tracking service providers:

- Long-term partnerships. Car leasing companies depend on tracking services for the entire agreement term. This guarantees lasting collaborations and a consistent revenue stream for your business.

- More services, more revenue. GPS tracking goes beyond just location tracking. It includes additional services like maintenance scheduling, engine blockage, and so on. These extra offerings add value to your work and increase your profits.

- Tapping into growth. The car leasing industry is growing and attracting new players. If you position yourself as a valuable partner in car leasing, you’ll attract more companies seeking this specialized expertise.

Addressing car leasing industry challenges with GPS tracking solutions

To become a major player in the car leasing industry, you need to customize your GPS tracking solutions to meet the sector’s unique needs. Here’re some of the major ones:

- Payment risks. Payment risks are a significant challenge for leasing companies. Each missed payment means a direct financial loss. And a cascade of such payment defaults could potentially push the company into bankruptcy. That’s why car leasing companies are actively seeking solutions to proactively manage and reduce payment risks.

- Car repossessions. Car repossessions happen when a lessee doesn't return a leased vehicle on time or doesn’t pay as agreed. In this case, the car is considered stolen for the dealer. And of course, they want to quickly get it back. But the dealer first needs to locate a stolen car, and this can be tricky. That’s why leasing companies are interested in integrating car theft tracking systems into leased vehicles to monitor their location continuously.

- Asset management worries. Vehicles under lease remain the property of leasing companies. If the vehicle is treated poorly, it loses its value fast. That’s why leasing companies want solutions that will monitor their assets’ condition and reduce wear and tear while they still own those vehicles.

As a GPS tracking service provider, you have the expertise to provide solutions that ease these burdens. Let's see how you can help leasing companies.

Improving vehicle fleet leasing with GPS tracking

Here’s how GPS tracking helps car leasing companies with fleet management and leasing.

1. Avoiding payment risks

Imagine a leased car vanishing without GPS tracker installed. The leasing company has no idea where it is or what's happening. The vehicle might violate every leasing contract rule, like going over mileage limits or entering off-limits zones. Missed payment deadlines add to the chaos. As a result, the leasing company faces financial losses and potential legal disputes.

GPS tracking service providers offer several tools for reducing these risks:

- Real-time monitoring. Uninterrupted, real-time visibility into the location and status of leased vehicles is essential for car leasing companies. With GPS tracking, they can closely monitor their assets regardless of where they are. Such control reduces many risks of misuse or unauthorized use that could lead to disputes between the lessee and the leasing company.

- Geofencing and alerts. With geofencing, leasing companies can set virtual boundaries for their leased vehicles. When a vehicle enters or exits these predefined areas, the system promptly sends alerts. This feature helps leasing companies stay aware of the vehicles' movements and react right away, especially in cases where vehicles shouldn’t leave specific areas.

- Payment reminders. GPS tracking systems can be integrated with payment reminder applications. In this case, leasing companies would send automated reminders to clients for lease due dates or missed payments. This helps clients stay informed about their financial responsibilities.

In essence, your expertise can improve the safety and security of leased assets and minimize financial risks for leasing companies.

2. Reducing the costs of car repossessions

In the leasing industry, the nightmare scenario often involves repossessing a vehicle when clients don't pay or break contracts. This process is not only costly. It also disrupts the flow of leasing businesses that have to spend money on repossession instead of buying new cars or improving customer support.

GPS tracking technology can be a game-changer for leasing companies that want to reduce costs and complexities associated with vehicle repossessions. Here's how it helps:

- Stolen vehicle recovery. If the car is stolen or a lessee fails to return it, real-time tracking makes it much easier to track the stolen car with GPS. Additionally, it enables leasing companies to collaborate with law enforcement, providing the exact location for a quick recovery.

- Remote vehicle disabling. Some advanced GPS tracking systems can remotely disable a vehicle's engine, immobilizing it until recovery agents arrive. This helps prevent irresponsible clients from using the vehicle further during repossession.

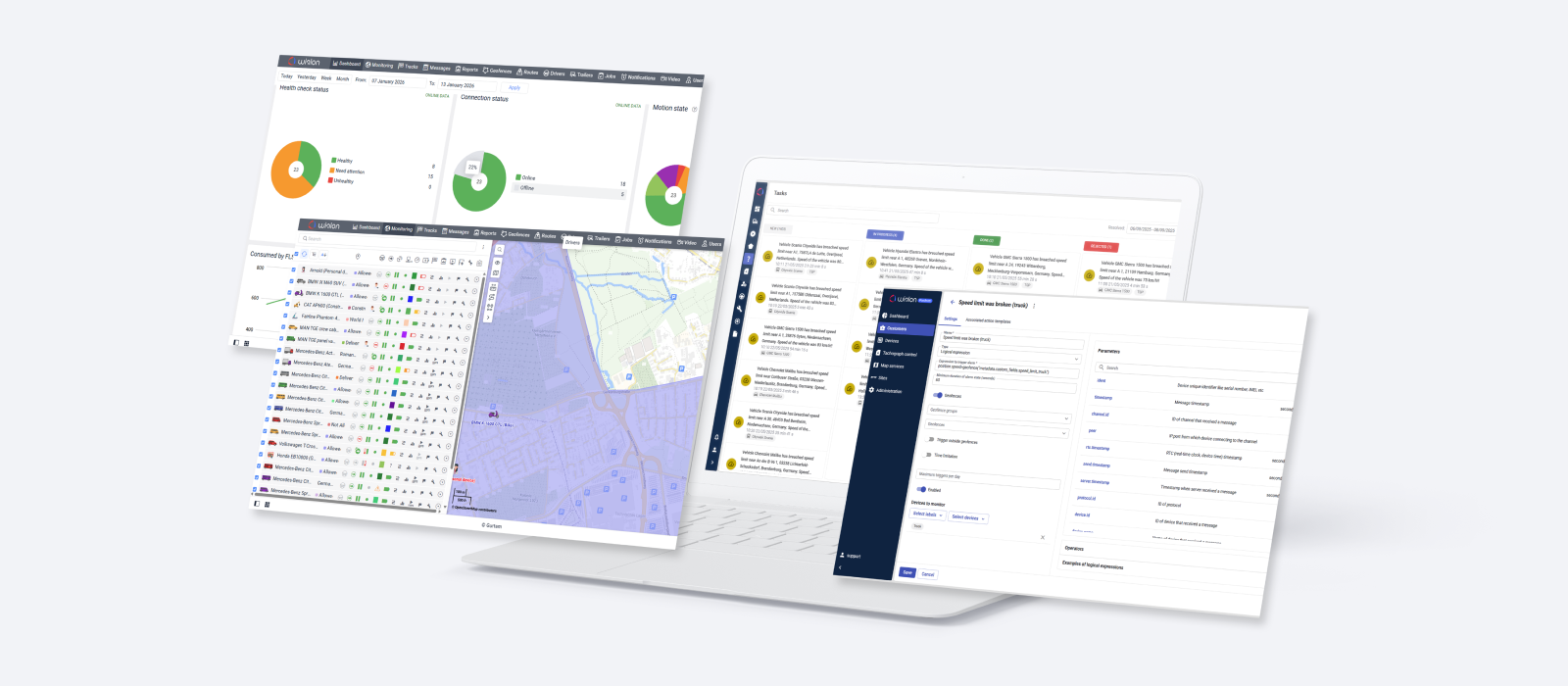

| One such example is the leased fleet GPS tracking functionality from Wialon. It allows leasing companies to remotely disable a leased car's engine. For more details, check out the vehicle leasing software. |

- Data for legal documentation. In case of disputes during vehicle repossession, like disagreements about mileage, GPS tracking provides solid evidence. Detailed records of a vehicle's location and usage help leasing companies build a strong legal case to protect their interests.

With your help, leasing companies can significantly reduce the costs and complexities associated with vehicle repossessions. This approach doesn't just save money; it also maintains their reputation as a serious and reliable player.

3. Ensuring high-quality asset management

Car leasing companies want to keep their leased vehicles in good shape so they stay valuable and work well for customers. The challenge is making sure each vehicle gets the right care and attention, considering they all have different needs. It can be a bit tricky to manage everything without the right maintenance tools and plans.

This is where GPS tracking can save the day and help leasing companies manage their assets seamlessly:

- Customized maintenance schedules. GPS tracking helps leasing companies monitor important metrics like mileage, engine hours, and maintenance history in real-time. With this data, companies discover each leased vehicle's actual usage patterns. As a result, they can create personalized maintenance schedules for their vehicles.

- Maintenance alerts and reminders. Automated alerts make sure leasing companies know when it's time for scheduled maintenance. This ensures they take care of things on time, improving customer satisfaction and loyalty.

- Timely maintenance requests. If something goes wrong with a car, GPS tracking systems send immediate notifications to leasing companies. This allows timely intervention to prevent breakdowns and accidents.

As a GPS tracking service provider, your expertise becomes vital for implementing these maintenance strategies. You can assure leasing companies that their assets will receive optimal care throughout the lease period.

Choosing the right vehicle fleet leasing tracking system

So, you've identified the potential in the car leasing business and now have ideas on how you can assist leasing companies. That’s great! Now, let's try and choose the right tracking system. Here are some key factors to keep in mind:

- Cost-effectiveness. Your services will only be competitive if the total cost of implementing and maintaining your solution is reasonable. So, when choosing, consider setup costs and subscription fees. If its price keeps your services on par with other GPS tracking service providers, it could be a good choice.

- Quick deployment. Your clients may already use specific device models and want a GPS tracking solution that seamlessly integrates with them. So, review the list of supported devices. If your client’s devices are on the list or the list keeps growing quickly, setup will be simple, and clients will soon enjoy the benefits of the solution.

- Customization. Look for an open API in the solution. It would allow you to tailor the solution to the client's needs.

- Scalability. Make sure the solution can handle a large amount of data from different leased cars. For this, check its storage capacity; if it can store data for 90 days, the solution is ready to effectively manage a lot of data.

- Customer support. Ensure you won't be left alone with questions and concerns about the solution. In this situation, both onboarding and ongoing assistance are crucial. It's a positive sign if the software provider offers customer training and support.

Depending on all the factors combined and your personal business strategy, you can choose between two tracking options for fleet car leasing.

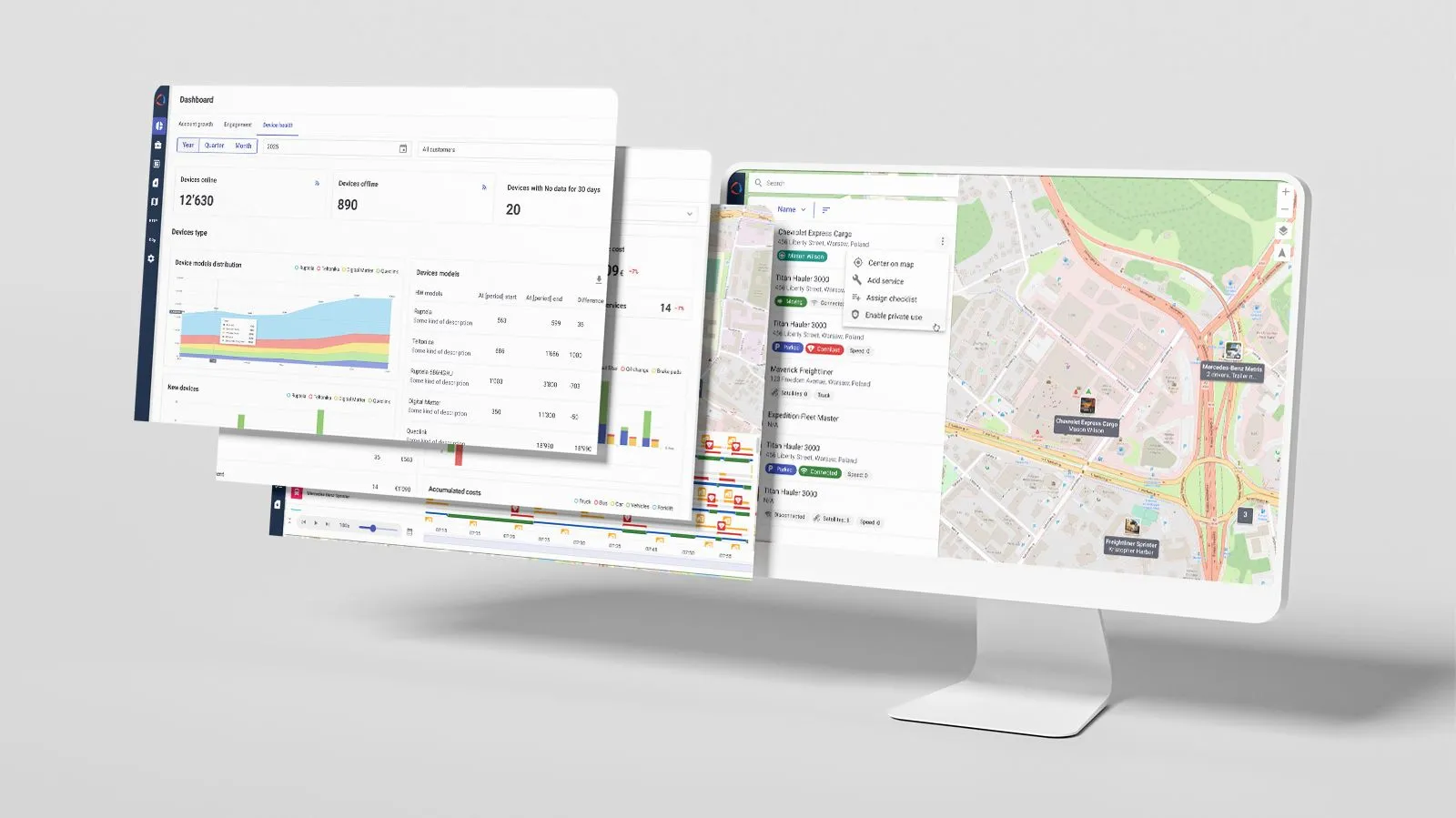

Option one: a universal GPS tracking platform

This option gives you a flexible solution, so you can choose only the features your client needs. This could include automated payment alerts, geofencing, maintenance plans, and more.

Option two: a niche car theft tracking system

Such systems are tailored to the needs of the leasing industry. They feature basic yet highly specific leased fleet GPS tracking functionality. When considering, prioritize remote engine blockage – a key feature for quick and cost-effective repossessions.

Bottom line

The vehicle leasing industry has its challenges, but these challenges are also big chances for telematics service providers. If you handle them well, you can stand out in the industry. To achieve that, you can use your GPS tracking expertise and create smart, affordable, and tailored systems that truly make a difference. By helping car leasing companies cut costs, reduce risks, and attract clients, you can win new long-term customers and increase profits.

.png)

.png)